simulation: Data Latency and Market Feeds

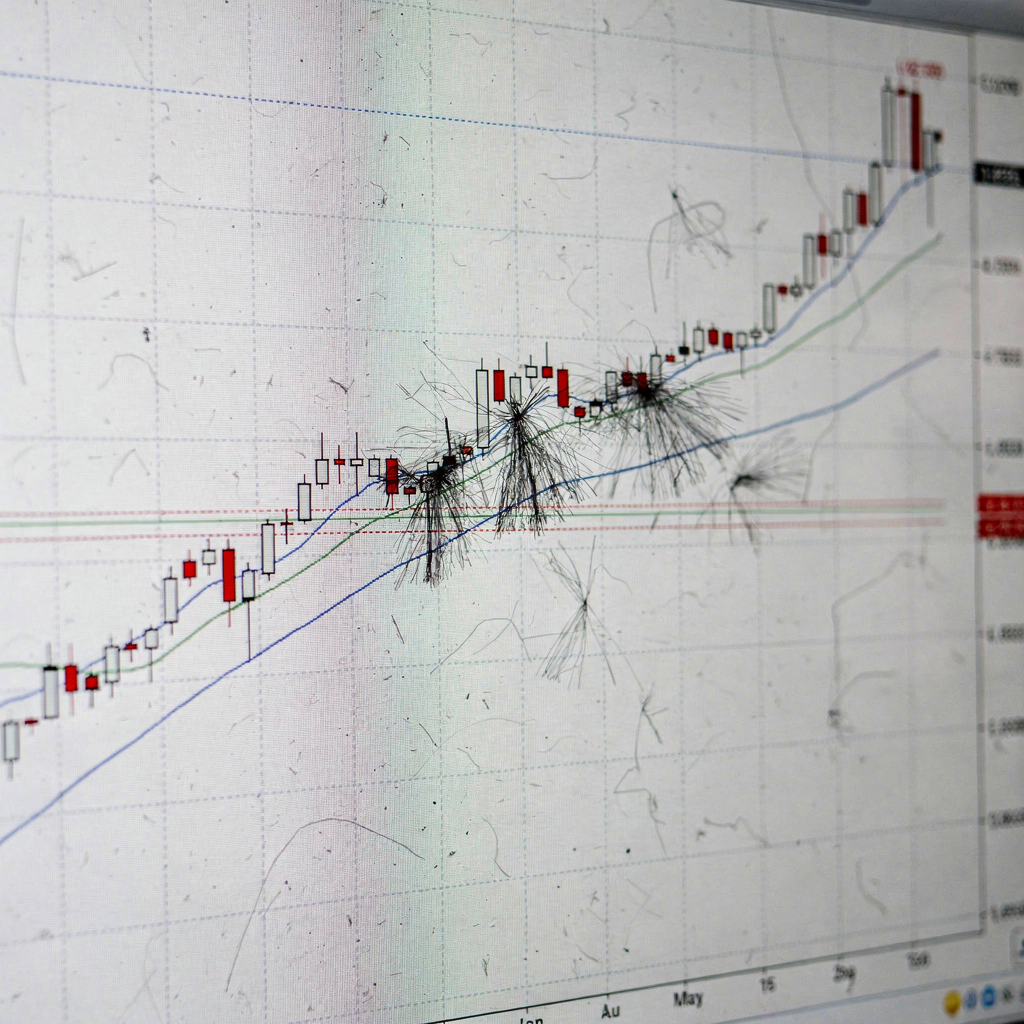

First, a clear distinction exists between live feeds and demo feeds on thinkorswim. For example, thinkorswim® papermoney® shows delayed quotes for many equities. This delay can be significant: some users report delays up to 15 minutes for certain stocks, especially when feeds come from delayed vendors “Why are thinkorswim quotes delayed on paper trading?”. Second, live trading on thinkorswim typically receives real-time prices or near real-time prices, while the simulation environment relies on snapshot updates and delayed feed vendors. Therefore, the freshness of data diverges sharply across accounts. Third, this timing gap matters for fast strategies. Scalpers, day traders, and algorithmic testers expect sub-second updates. However, when quotes lag by seconds or minutes, execution decisions shift and results differ. For instance, a scalper who depends on sub-second momentum will see simulated fills that would not appear on a live order entry.

Next, the variety of feed types also explains differences. Some demo feeds use consolidated feeds that intentionally aggregate and delay. Conversely, real accounts may include direct exchange feeds or premium consolidated packages. Thus, knowing the feed type helps you interpret your practice trades. Also, traders testing strategies that act on S&P 500 components need real-time access, since volatility and intra-day patterns can change quickly. For accurate benchmarking, confirm which vendor supplies your feed. For further context on simulation tools and integration with trading systems, see resources on simulation and optimisation tools for TOS simulation and optimisation tools for TOS. Finally, when you simulate with a delayed feed, your ability to measure slippage, short-lived momentum, and microstructure reaction weakens. Consequently, manage expectations: paper outcomes often overstate the speed and precision you can achieve live.

simulator: Order Execution and Fill Price Accuracy

First, the core difference in execution lies in how orders meet the market. In live trading, trades interact with an order book, which drives fills, partial fills, and slippage. By contrast, the paper environment applies an algorithmic fill model that assumes immediate execution at a reference price. Thus, the simulated fill model can produce optimistic results. Second, empirical studies note that simulated fills often diverge from live fills by small percentages. For instance, research and market commentary indicate fill price variance in simulations often ranges from 0.1% to 0.5% compared to real market fills Understanding Level II Quotes. This difference matters for strategies with tight profit margins because a 0.1% price swing can flip a winner to a loser.

Next, note how the simulated engine calculates an output when you submit an order. Many demo systems select the last quoted price or mid-price and assume full execution. Consequently, the simulation omits queue priority and partial fills. Also, market orders in the paper model may not reflect hidden liquidity or iceberg orders. Therefore, testing a limit-order strategy in simulation can mislead you about fill probability and execution timing. For traders who automate, the distinction matters further: real-world order routing and exchange fees influence net results. For a deeper look at testing and tools that mirror execution mechanics, you can explore open-source terminal simulation software open-source terminal simulation software. Finally, keep records of your simulated fills and compare them to live fills when you move small positions to a real account to quantify the gap.

Drowning in a full terminal with replans, exceptions and last-minute changes?

Discover what AI-driven planning can do for your terminal

trading platform: Market Impact, Slippage and Depth

First, live market impact is a direct consequence of order size and order-book depth. When you place a large buy order, the market can move against you while your order executes. Conversely, in simulation, large orders frequently clear at the displayed ask with no price pressure. Second, the absence of market impact in demo runs causes many strategies to look more profitable than they will be under live conditions. Third, traders should consult Level II data to estimate real slippage. As Investopedia explains, Level II depth helps reveal queue dynamics and true available liquidity Understanding Level II Quotes. In practice, ignoring depth leads to underestimating execution costs and overall risk.

Next, volatility amplifies this issue. During high volatility events, price variation grows and liquidity can evaporate. For example, a simulated market might show a stable price series, while the live market for the same symbol on the S&P 500 can gap, widen spreads, or experience jumps. Consequently, your model’s variance will change when you move from paper to live. Also, partial fills and order queue priority commonly cause slippage in production systems and trading desks. Therefore, when testing impact-sensitive orders, you should add realistic slippage assumptions or run small-scale real trades to measure real costs. Finally, if your strategy regularly trades large sizes, simulate different levels of market depth and include a slippage schedule that reflects size and intraday liquidity patterns.

charles schwab: Infrastructure Behind thinkorswim® PaperMoney®

First, the infrastructure that powers demo accounts comes from the brokerage’s architecture. In the case of thinkorswim, Charles Schwab provisions different data privileges between live and demo accounts. For instance, the demo environment often has restricted feed permissions and may use consolidated or delayed feeds rather than direct exchange streams. Schwab documentation and tutorials explain how paper accounts operate and what limits apply thinkorswim® paperMoney® tutorial. Second, API access and data permissions typically differ between account types. Live accounts often gain broader API or market feed access, while demo accounts receive a reduced set to prevent misuse and to save cost.

Next, the platform’s interface choices and mobile app features can also vary. For example, some tools present simulated trading windows that do not reflect certain exchange-only order types. Also, platform frameworks control how state updates are handled; some demo systems rely on synchronous updates, while others batch updates asynchronously to conserve resources. Therefore, when you study the platform’s documentation, verify which features match your intended workflow. Also, if you plan to integrate automation or third-party connectors, check whether your live account will permit the same API endpoints and data subscriptions. Finally, be aware that broker-specific quirks and fee structures affect outcomes when migrating strategies from paper to live.

Drowning in a full terminal with replans, exceptions and last-minute changes?

Discover what AI-driven planning can do for your terminal

better trading platform: Integrating Simulation with Live Observation

First, combine hands-on simulation with live observation to reduce surprises. For example, run paper trades while watching live charts and Level II liquidity. Next, build a simple workflow that links watchlists, alerts, and practice orders. Also, use the practice phase to test automation and LLM-driven signal pipelines. In small, controlled trials, an LLM can parse news and flag potential setups, but you should monitor outputs before entrusting capital. For coding tasks and automation tests, use controlled testing environments so you can iterate without harming live accounts.

Next, choose the right tools to support your goals. A better trading platform for testing should let you replay historical ticks, tag fills with notes, and export execution logs. Moreover, you can simplify risk transitions by starting with micro-size orders and scaling once you confirm execution assumptions. Also, lean on watchlists and alerts to track symbols you tested in paper mode. For traders seeking deeper integration, explore tutorials on how to simulate operations and transfer learnings to live rules how to simulate container terminal operations. Finally, remember that simulated training often serves as an educational sandbox, and you should treat the application is for educational purposes while you build confidence.

successful simulation: Bridging the Gap to Live Trading

First, psychology matters. Traders often show overconfidence in a zero-risk environment. Therefore, impose rules that mimic real allocation, margin, and fees. Next, design a gradual deployment plan. Start with small sizes to test state changes and order-routing behavior under live conditions. Also, track performance metrics that matter: realized slippage, fill rates, and execution variance. Record these metrics in a way that supports later analysis and optimization opportunities.

Next, use simulation to assess viability before full deployment. For example, measure how your strategy behaves across different volatility regimes and unexpected news. Also, consider how llms can assist with research; yet, treat their outputs as suggestions and not as final trading signals. Importantly, do not expect simulation to fully demonstrate superior performance: the demo environment cannot model every market nuance or market-maker behavior. Furthermore, maintain a compliance mindset: use simulations for illustrative purposes and for general informational purposes, not as a guarantee of future returns. If you need clarity on advice, remember that simulations cannot provide individualized recommendation or personalized investment and should not be a substitute for recommendation or personalized investment advice. Finally, treat the transition as an exercise in scaling: measure, adjust, and redeploy gradually while collecting data and avoiding major bottleneck failures. By taking measured steps and tracking data collection, you increase the chance that your simulated edge translates to sustainable real-world performance.

FAQ

What is the main difference between thinkorswim live and paper trading?

The main difference is the freshness of data and execution realism. Live accounts get near real-time feeds and interact with an actual order book while paper accounts often use delayed feeds and a simplified fill model.

How long can paper trading quotes be delayed?

Delays vary by vendor, but some delayed feeds can lag by up to 15 minutes. This lag affects strategies that depend on immediate price changes and tight spreads source.

Do simulated fills match live fills exactly?

No. Simulated fills often assume immediate execution and can differ from live fills by a small percentage, commonly in the 0.1%–0.5% range, because simulations omit queuing and slippage source.

Can paper trading mislead my performance expectations?

Yes. Without market impact and realistic slippage, simulated strategies can overstate profitability. Use small live trades to validate simulated results before scaling.

How should I test automated strategies safely?

Test in controlled testing environments, use small live sizes initially, and monitor state changes and execution logs. Also, isolate coding tasks to ensure robustness before full deployment.

Are there limits to API access in demo accounts?

Often yes. Demo accounts may restrict API endpoints and data permissions compared with live accounts. Check broker documentation and confirm which features you will have live source.

How can I account for slippage in simulation?

Add conservative slippage models and test across several volatility regimes. Also, record actual fills from initial live trades to calibrate your slippage assumptions.

Should I use paper trading for long-term strategy development?

Yes, but combine it with live observation and small live experiments. Paper trading is useful for concept validation, but you must test execution in production systems for real viability.

What role does psychology play when moving from paper to live?

Psychology is crucial. Traders often take more risk with simulated capital. Create rules that mirror real allocation and fees to manage behavior and reduce overconfidence.

Where can I learn more about tools for simulation and optimization?

Explore resources that describe simulation and optimisation tools for trading and operations, including how to simulate complex workflows and terminal operations learn more. These resources can help you design testing that better reflects production realities.

our products

stowAI

stowAI

stackAI

stackAI

jobAI

jobAI

Innovates vessel planning. Faster rotation time of ships, increased flexibility towards shipping lines and customers.

Build the stack in the most efficient way. Increase moves per hour by reducing shifters and increase crane efficiency.

Get the most out of your equipment. Increase moves per hour by minimising waste and delays.

stowAI

stowAI

Innovates vessel planning. Faster rotation time of ships, increased flexibility towards shipping lines and customers.

stackAI

stackAI

Build the stack in the most efficient way. Increase moves per hour by reducing shifters and increase crane efficiency.

jobAI

jobAI

Get the most out of your equipment. Increase moves per hour by minimising waste and delays.