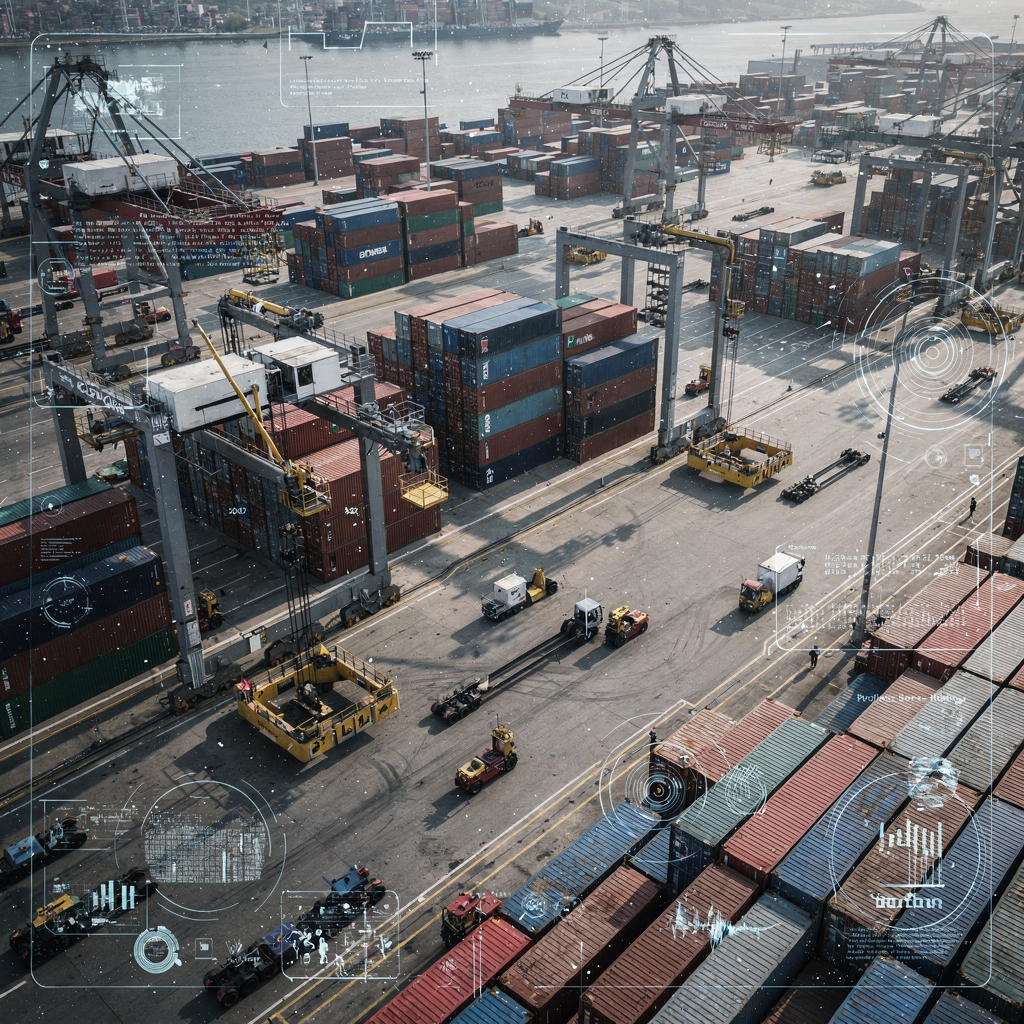

Port Automation and the Terminal Market Landscape

Port automation describes the systems and processes that automate manual tasks across an entire port. It helps modernise maritime freight and improve throughput. Today, operators use sensors, AI, robotics and integrated management systems to automate routing, equipment dispatch, and yard stacking. These changes make the entire port more predictable and easier to manage. For context, the automated container terminal market was valued at USD 10.89 billion in 2023 and is forecast to reach USD 18.95 billion by 2030, growing at a CAGR of 7.8% between 2024 and 2030. Also, longer-term estimates expect the market to expand to USD 22.4 billion by 2035, reinforcing that terminals will attract steady investment and upgrades (research projection).

Regional adoption varies. The port of rotterdam and the port of shanghai show how national strategy and scale drive change. Rotterdam has invested in digital twin pilots and berth automation. Shanghai runs large automated blocks and experiments with advanced AGV fleets. In both examples, terminal operators work with technology providers to test systems before wider roll-out. For readers interested in how berth and crane planning get modernised, our guide on container terminal berth and crane planning best practices explains practical steps and metrics.

Policy and investment trends also matter. Port authorities and national maritime agencies fund trials and public-private partnerships. As a result, investment cycles now include CAPEX for automated cranes and software, as well as operating budgets for skills development. Investment decisions increasingly focus on creating automation-ready capabilities, as consultants note that building those capabilities reduces uncertainty and accelerates benefits (industry guidance).

Finally, note new terminology cropping up in technical procurement. Buyers request a terminal operating system that can integrate with third-party AI systems and with legacy TOS. They also look for vendors that support a digital transformation strategy. For terminals considering a phased approach, the terminal market now supports pilots, brownfield upgrades, and greenfield builds. This combination of demand, policy, and technology is why ports are increasingly prioritising automation and why industry attention remains high.

Autonomous Container Terminal Operations for Cargo Handling

Autonomous container terminal operations centre on reducing human manual work while keeping human oversight. AI-driven predictive analytics forecast container arrivals, chassis needs, and peak planning windows. For instance, AI systems use data and advanced analytics to predict peaks and map chassis positioning across the yard (AI advances in terminal operations). These predictions let terminals automate move sequencing and reduce rehandles, which improves operational efficiency and lowers fuel consumption.

Operators deploy automated guided vehicles and remote-control cranes to keep equipment moving 24/7. Automated guided vehicles and AGVs support continuous quay-to-yard transfers while operators manage exceptions. The use of automated cranes and autonomous cranes on the quay helps lift more moves per hour. Automation reduces fatigue-related mistakes and lowers the accident rate. As a result, terminals can run longer shifts with better consistency and fewer safety incidents.

Human–machine interaction remains central. Staff shift from repetitive tasks to supervisory roles such as system monitoring, incident resolution, and maintenance planning. This change supports the future of work and helps terminals retain experienced staff while retraining them for digital roles. Loadmaster.ai sees this shift in practice. Our reinforcement learning agents, such as StowAI and JobAI, augment vessel planning and dispatching so planners spend less time firefighting and more time supervising robust plans. For planners interested in vessel sequencing, our whitepaper on stowage planning fundamentals for port operations explains how AI augments human decisions.

Safety gains come with measurable cost savings. Terminals report fewer rehandles, balanced workloads for RTG and straddle fleets, and more stable crane productivity. These improvements reduce idle equipment time and cut fuel consumption by shortening travel distances. In short, the move to automated cargo handling and automated terminal controls delivers faster vessel turnaround, reduced dwell time, and a clearer path to achieving sustainability targets.

Drowning in a full terminal with replans, exceptions and last-minute changes?

Discover what AI-driven planning can do for your terminal

Smart Port Innovations: From Automated Container to Seamless Logistics

Smart port deployments connect sensors, systems, and stakeholders to create continuous, data-driven workflows. IoT sensors and digital twin technology provide real-time visibility of container yards, equipment status, and cargo manifests. A digital twin lets operators simulate operations before they affect the quay. This allows them to optimize flows and avoid bottlenecks. For terminals planning predictive maintenance of cranes, our guide on predictive maintenance for deepsea cranes offers a practical roadmap to lower downtime.

Integrated terminal operating systems enable seamless exchange of schedule and cargo data among shipping lines, truckers, and rail operators. The terminal operating system becomes the connective fabric that ties berth planning to yard slots and gate appointments. With these links in place, terminals can offer just-in-time vessel scheduling and automated cargo tracking, which reduce vessel waiting times. Consequently, berth optimisation delivers lower fuel consumption for ships that spend less time idling at anchor.

Economically, the benefits of a smart port include lower operating costs and improved cost savings on equipment and labour. Environmentally, ports can reduce emissions by optimising crane cycles and managing truck flows to cut idle time. Also, smarter control of container yards and container yards layouts creates room to pack more throughput into existing land footprints. For terminals wanting to integrate yard automation and equipment dispatch, our post on equipment dispatching to reduce empty driving examines how to shorten distances and balance workloads.

Beyond technology, stakeholders must agree on data standards and interoperability. Port authorities, terminal operators, and carriers contribute to a port ecosystem that supports data sharing. When they do, the smart port delivers faster customs clearance, fewer delays, and smoother cargo flows. This level of integration is not just a technical upgrade; it reorganises how maritime transport and container shipping coordinate across the supply chain.

Emerging Technologies to Enhance Efficiency and Port Efficiency Beyond Automated Machinery

Emerging technologies extend capabilities beyond cranes and AGVs. AI, machine learning and blockchain work together to secure transactions and support data-driven decision-making. For example, AI systems analyse cargo patterns and propose yard placements. Machine learning refines those recommendations as conditions change. Meanwhile, blockchain can lock in verified handovers for container manifests and gate transactions, improving auditability.

Connectivity is another cornerstone. 5G networks and edge computing deliver low-latency control for autonomous systems. This enables operators to run real-time control loops for cranes and AGVs without unacceptable delays. Drones and automated inspection robots perform visual checks on cranes and spreaders, enabling predictive maintenance and faster repair cycles. These tools reduce downtime and extend equipment life, which improves both operational efficiency and fuel efficiency.

Energy management also plays a role. Terminals integrate renewable generation and energy-efficient machinery to cut emissions. Battery-electric AGVs and cranes reduce fuel consumption, while energy storage enables peak shaving and lower grid demand. Loadmaster.ai supports these goals indirectly by reducing unnecessary moves through better sequencing. Our RL-based approach creates measurable improvements in route planning and rehandle reduction, which lowers overall energy usage.

Finally, the combination of advanced sensors, AI systems and digital twin technology helps terminals shift from reactive problem solving to strategic optimisation. The result is a more resilient port that can adjust to demand spikes and disruptions. These emerging technologies therefore deliver benefits that go far beyond automated machinery and support a more sustainable and efficient maritime transport network.

Drowning in a full terminal with replans, exceptions and last-minute changes?

Discover what AI-driven planning can do for your terminal

Port Automation Challenges in the Future of Automated Cargo

Adopting automation systems presents challenges that planners must manage. First, the high upfront capital expenditure for cranes, AGVs, and software can extend payback periods. Terminals need clear investment cases that include expected cost savings from fewer rehandles and improved operational efficiency. For many terminal operators, phased roll-outs and pilots mitigate financial risk and build confidence before site-wide upgrades.

Second, cybersecurity now sits alongside mechanical safety as a primary concern. Autonomous systems and AI systems require resilient, protected networks. Ports must defend against threats that could interrupt terminal operations or corrupt data. To help, terminals develop layered defenses and continuous monitoring programs. Our post on cybersecurity in automated port operations highlights practical controls and governance steps.

Third, the skills gap matters. Automation requires new roles for data analysts, AI engineers, and maintenance specialists. Terminals must provide training and career pathways so staff can transition to supervisory and technical roles. This investment in people supports the future of work inside terminals and helps retain institutional knowledge.

Fourth, interoperability and legacy systems complicate deployment. Ports often run mixed-mode operations with manual areas next to automated blocks. The terminal operating and management systems must integrate with older equipment and with new automated terminal technologies. This can slow roll-outs and require custom interfaces. Still, suppliers and technology providers are responding with more modular solutions. To reduce onsite risks, many operators run a digital twin or sandbox before live deployment, which helps model outcomes and stress-test automation requires and assumptions.

Future of Automated Container Terminal: Market Projections and Strategic Insights

The future of automated container terminal growth looks strong. Market forecasts to 2035 put the sector at USD 22.4 billion, driven by demand in Asia and Europe and by investments in major container terminals and greenfield projects. Growth hinges on regions that host major container ports and on operators willing to trial fully automated blocks, followed by scale-up. Terminal types that benefit most include deepsea container terminals and barge-linked hubs that need tight coordination to manage cargo flows efficiently.

Strategically, terminals should adopt a road map that combines pilot projects, partnerships, and standards-driven integration. Industry partnerships accelerate vendor selection and reduce integration risk. Standardisation on APIs and data formats helps terminal operators connect new systems to existing terminal operating systems. For readers who want examples of integrated software plugins, see our piece on TOS-agnostic software plugins for terminal operations, which explains how to keep options open when you automate.

Sustainability remains central to planning. Terminals set net-zero ambitions and embrace circular-economy practices such as battery reuse and equipment remanufacturing. These steps reduce emissions and operating costs while supporting regulatory goals for international maritime compliance. In parallel, automation delivers benefits of reduced vessel dwell time and lower fuel consumption per move.

Looking toward full autonomy, the vision combines AI-driven port orchestration, fully autonomous vehicles, and fully autonomous cranes under a resilient digital twin and robust security posture. While some ports will reach fully automated terminal status sooner than others, the overall trend is clear: ports that integrate AI, machine learning, and reliable operations will shape the future of port trade and enable smoother global trade volumes. As one industry voice put it, “The interaction between humans and machines is already proving its worth for economic and innovative success” (industry insight).

FAQ

What is port automation?

Port automation refers to technologies and processes that automate tasks across a port, from crane control to yard stacking. It uses sensors, AI, and integration to reduce manual work and improve throughput.

How does AI improve terminal operations?

AI improves decision-making by forecasting demand, optimising stowage, and coordinating moves across quay, yard, and gate. AI systems can run simulations to reduce rehandles and support consistent performance.

Are automated container terminals cost-effective?

They can be, though the upfront investment is significant. Terminals secure cost savings through fewer rehandles, lower fuel consumption, and better equipment utilisation over time.

What role do digital twins play in ports?

Digital twins simulate terminal layouts and operational scenarios, allowing operators to test changes and train reinforcement learning agents without disrupting live operations. They reduce deployment risk and speed up optimisation.

How do ports manage cybersecurity for automation systems?

Ports implement layered defenses, continuous monitoring, and incident response plans to protect automation systems. They also use secure APIs and vendor controls to limit exposure.

Will automation eliminate jobs at terminals?

Automation shifts job profiles rather than simply eliminating roles. Workers move into supervisory, technical, and maintenance positions that support and monitor automated systems. Training programs make this transition possible.

Can older terminals upgrade to become automated?

Yes, many terminals adopt phased upgrades and pilot zones to integrate automated cranes and AGVs with legacy systems. Modular solutions and TOS-agnostic plugins help bridge old and new systems.

What is the timeline for reaching fully autonomous terminals?

Timelines vary by region, regulatory environment, and investment capacity. Some greenfield sites may reach fully autonomous operation sooner, while brownfield sites often take phased steps over several years.

How do automated systems affect environmental performance?

Automation can reduce vessel dwell time, optimise crane cycles, and lower fuel consumption for trucks and ships. These improvements help ports lower emission levels and meet sustainability targets.

Where can I learn more about practical AI solutions for terminals?

Explore resources on reinforcement learning for vessel planning and yard optimisation, including detailed guides and case studies on platforms that specialise in terminal optimisation. For example, our pages cover stowage planning and predictive maintenance to show real deployments and outcomes.

our products

stowAI

stowAI

stackAI

stackAI

jobAI

jobAI

Innovates vessel planning. Faster rotation time of ships, increased flexibility towards shipping lines and customers.

Build the stack in the most efficient way. Increase moves per hour by reducing shifters and increase crane efficiency.

Get the most out of your equipment. Increase moves per hour by minimising waste and delays.

stowAI

stowAI

Innovates vessel planning. Faster rotation time of ships, increased flexibility towards shipping lines and customers.

stackAI

stackAI

Build the stack in the most efficient way. Increase moves per hour by reducing shifters and increase crane efficiency.

jobAI

jobAI

Get the most out of your equipment. Increase moves per hour by minimising waste and delays.